How media buyers are appraising free streaming services despite transparency hurdles

Free ad-supported streaming services are jostling to complement the growing number of subscription on-demand services, offering consumers large libraries of content at no extra cost.

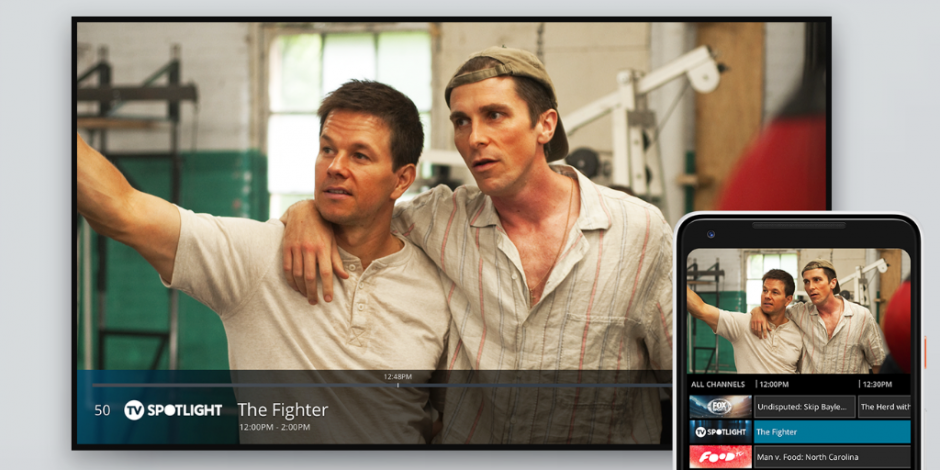

Pluto TV has both a digital linear and on demand offering

As the likes of Pluto TV, Tubi and Xumo compete for audiences, they’ll have to demonstrate to both consumers and ad buyers their unique selling points, especially their content offerings.

“Some of the same content providers are distributing in many places and it starts to be a big blur,” said Susan Schiekofer, US chief digital investment officer at GroupM. “You feel like you've seen some of the same movie clips in everybody's reel about the content that they're streaming. That part's been pretty challenging.”

Pluto TV has around 175 content partners and over 240 channels, including a growing number from parent companyViacomCBS.

Tubi looks more like a free version of Netflix, minus originals. It hosts over 15,000 movies and TV shows, a move partly designed to provide advertisers with brand-safe inventory that’s been rated by the Motion Picture Association of America and TV Parental Guidelines.

Xumo instead embraces digital content. Some of its 600-plus channels are branded by digital media companies such as Condé Nast, People and Sports Illustrated. It, like Pluto TV, also includes live news programs.

Pluto TV and Tubi both say they have around 20 million monthly active users, though neither service would share its definition of how it counts a user. Xumo would not share its current user count, but The Drum understands it’s north of 8 million users.

Advertisers want to reach large audiences, but in streaming they prioritize unique reach – reaching viewers who cannot be found in other TV environments.

“The main thing that we look at is what is their unique reach,” said Brad Stockton, vice-president of video innovation at Dentsu Aegis Network. “What are those audiences and what is the scaled opportunity across those partners, because if the inventory is the same that's one piece of it, but if there are unique audiences from one platform to the next… then there's still a unique opportunity to drive incrementality from one to the next.”

Proving the incremental reach of an ad buy on one of these services can be difficult, especially given the lack ofstandards in the space.

Advertisers have to rely on self-reported figures that are calculated differently from service to service. Executives from Pluto TV and Tubi have told The Drum that they don’t plan on sharing how they define user engagement with their services until there’s an agreed-upon industry standard.

Stockton said “the unfortunate truth” is the best way to understand reach is to buy on a service and measure the results, which can sometimes reveal a service's “CPMs aren't reflective” of the size it claims.

Stunting growth

Neither Pluto TV, Tubi nor Xumo has plans to produce original content for their platforms. Since their linear and on-demand libraries are largely filled with second-run content, advertisers need to define what counts as quality content, which can differ from brand to brand.

“[Streaming services] need to accept our whitelist because our clients have very specific... do-not-air lists or whitelists, and they need to be able to work within each client's definition of what is quality,” said Schiekofer. “It does vary from advertiser to advertiser, and we need to make sure that they can suppress the inventory that we don't want, or conversely lean into the inventory that we do want.”

If an advertiser blacklists three shows – meaning they won’t let ads run against that content – they run the risk of unintentionally blacklisting an entire channel, or even an entire genre, because streaming services don’t make show-level data in programmatic buys.

Whether it’s to prevent cherry-picking popular content or to comply with the outdated Video Privacy Protection Act, streaming services don’t show what program advertisers are buying within a programmatic auction. Buyers only see channel, genre or rating information, depending on the service.

“Their lack of transparency is stunting growth,” said Schiekofer.

Some advertisers have less of a problem with streamers’ opacity since internet-delivered TV means advertisers can buy on audiences, not just on demographics and content like in traditional linear TV.

Charlie Chappell, head of integrated media and communications planning at The Hershey Company, said streaming means the brand can buy TV content in a more “powerful” way.

“We're very comfortable buying audience versus content, for the most part,” said Chappell. “For us and our brands, it's more about reaching the right consumer than it is being associated with the right content.”

Brands can have different strategies, but Schiekofer said “most clients care” about receiving as much information as possible.

“If it's a female-heavy [brand], we want to make sure we are leaning into associated content…,” said Schiekofer. “[Streaming services] are saying the same thing because the audiences deliver the shows, but if you don't actually get the detail how do you know that?”

Print the article

Print the article