Ones to watch: which brands are defining mobile marketing today?

Mobile marketing has been transformed over the last decade from a niche, even neglected, space to encompassing pretty much all marketing activity. But as it’s expanded, looking for inspiration – for the brands creating new products, audiences, and whole markets that didn’t previously exist, for the platforms that could be the pillar of your next media plan, for companies changing the mobile experience itself – has got harder.

Well, we’re here to help. In this article, The Drum’s reporting team, aided by our research experts, kick off our deep dive on Mobile by highlighting 10 brands to watch. From fintech to fitness and deliveries to dating, these brands all meet their customers on their mobile devices before they reach them anywhere else.

In this article, our research and reporting team highlights 10 brands that operate primarily in the mobile space that they’ve had their eyes on – and argue the case to make them top of your watch list, either as potential media channels or examples of cutting-edge marketing nous.

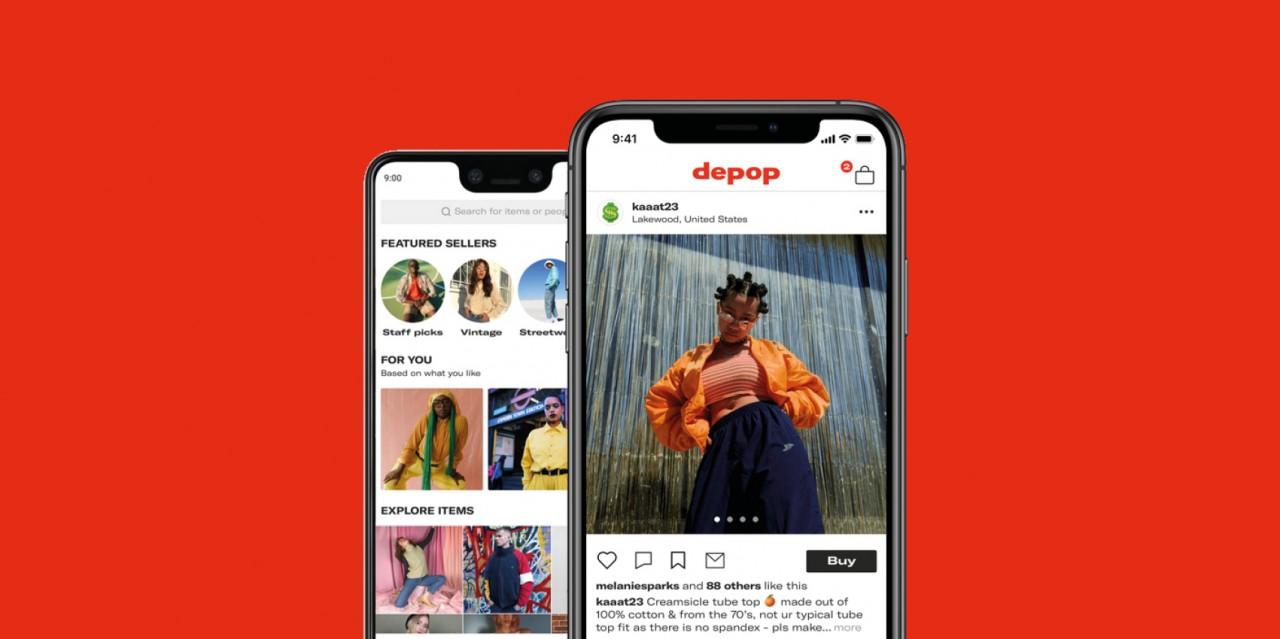

Where generation Z does business: Depop

They say imitation is the sincerest form of flattery, but in the mobile era, it’s actually a meme account about you. We’ll get into the details of the mobile-first fashion marketplace’s incredible growth shortly, but it’s worth noting that Depop Drama, the Instagram account that parodies the worst of the Depop selling and buying experience, has almost 650,000 followers itself.

This just goes to show that Depop isn’t merely a shopping utility, it’s an app that is now profoundly baked into the online cultural experience of many younger people. The actual user number of Depop shadows that of its meme account at 26 million worldwide. What’s more impressive than this is that 90% of those users are under the age of 26, and over $1bn has been made by people selling on the platform. This changes the dynamic from being a merely transactional mobile app to a powerful platform for young people to make money, start small businesses and find like-minded entrepreneurs.

This would have been a driving factor in the $1.62bn acquisition of Depop by crafty marketplace Etsy, which bought the app in June 2021. At the time of the acquisition, Depop chief exec Maria Raga told users: “Come to Depop for the clothes, but stay for the culture.” The deal secures Etsy a major foothold in the secondhand and SME selling community online globally.

According to Depop, the most searched for categories on the site are vintage, streetwear, one-of-a-kind and Y2K – ironically showing that, despite the young userbase, there’s a big trend for aesthetics from times gone by. There’s an opportunity here for anyone above its core age group still holding on to clothing from their youth.

It’s also an opportunity for brands. While the context of Depop isn’t to use it as a storefront, fashion brands like Anna Sui are using the platform to sell ‘archive’ clothing. This taps into the trends of its userbase and creates an exclusive reason for people to connect with the brand on the platform over the myriad other fashion marketplaces.

Charlotte McEleny, deputy and Asia Pacific editor

Brand love: Hinge

Hinge is different from other dating apps – at least that’s what the decidedly youthful brand says. It bills itself as the dating app ‘designed to be deleted’. That is, its target audience consists of singles who are looking for something a bit more serious than a hookup. Originally, Hinge only allowed users to match with other users if they shared a mutual friend. And from the get-go, the app’s design has supported its aim of appealing to those looking for a relationship; rather than a gamified UX designed primarily around swiping – the standard for many other dating apps today – Hinge encourages users to build detailed profiles and include answers to playful icebreakers to facilitate engagement.

Data from Pew Research indicated that, as of February 2020, some 30% of US adults had used a dating app or service – noting that usage varies significantly across different age groups and demographics. However, the pandemic supercharged the sector; with singles stuck at home with their screens, they swiped, video chatted and matched more than ever. And Hinge fared especially well: the company tells The Drum it saw app downloads grow a whopping 63% in 2020 compared to 2019.

It’s worth noting that Hinge was acquired by Match Group in early 2019. The conglomerate owns a large swath of the world’s most popular dating apps and sites, including Tinder, Match.com, OkCupid and Plenty of Fish. The acquisition of Hinge was seen as a strategic move to expand its customer base and diversify its portfolio with Hinge’s youthful but relationship-focused brand. With paid subscription-based membership options as well as a slew of recent partnerships with brands including Airbnb, Chipotle, Uber Eats and Uncommon Goods, Hinge offers Match Group valuable monetization opportunities.

By the end of 2025, the global online dating market is expected to be worth nearly $3.6bn, up from $2.23bn in 2019. As the eighth-highest ranked app in the Apple App Store’s Lifestyle category – coming in behind Pinterest, Tinder and Amazon Alexa – Hinge is well positioned to capitalize on this explosive growth.

Print the article

Print the article